“Радастея” – Печальная анaлогия

Радастея, 38–я Школа проходила на озере Сунгуль Южного Урала. Её организовывали жители города Снежинска. (Некогда — важный закрытый «почтовый ящик» с кодовым названием «Челябинск–70».) Люди из «ящиков» привыкли жить за колючей проволокой в режиме повышенной секретности. Они и здесь не сообщали нормального места встречи для людей из других городов, всё подбирали под себя, всего боялись. Мне была приготовлена стерильная палатка с главным врачом города; конечно, это была женщина. Мой же медик–ассистент в это время бродил с семьёй по берегам, не в силах найти наш базовый лагерь — место нашей «дислокации».

Через час после приезда наблюдаю следующую картину: на поляне возле «штабной» палатки женщина оставляет достаточно большой груз (весом не менее 80 кг), доставленный на носилках в машине скорой помощи, и быстро–быстро убегает в сторону дороги. Подхожу, вижу нечто, похожее на человеческое обезображенное тело без признаков разума на лице. Требую остановить женщину. Её возвращают. Она рыдает: «Дайте мне отдохнуть! Я только в сад сбегаю, я принесу вам корзину с клубникой. Отпустите всего на одну ночь». Я говорю: «Конечно, отпустим, но прежде поясните, что делать с несчастным существом, которое вы нам оставляете». Отвечает: «Это мой муж, он парализован уже в течение 25–ти лет. Его надо кормить через трубочку. Вот еда». Одного из дежурных сотрудников оставляю с рыхлым месивом одеял, подушек, подобия человеческого тела до утра. Утром возвращается улыбающаяся хозяйка. «Спасибо вам большое, я впервые спокойно поспала». — «Расскажите, пожалуйста, свою историю» , — обращаюсь. (more…)

“РАДАСТЕЯ” на самом деле

Я много лет успешно занимаюсь Методом 7Р0 (он же – РАДАСТЕЯ). И, естественно, мне более чем регулярно приходится объясняться на темы слухов о РАДАСТЕЕ. Ну, устроены так некоторые люди: услышали, недопоняли, тут же побежали «разъяснять» всем знакомым это самое недопонятое. А тут – тем более, разговор идет о методиках работы с мозгом, о связи мозга и времени… Понятно, что о РАДАСТЕЕ говорят много откровенно смешного.

В итоге моя идея самой написать об этой ситуации кончилась тем, что я увидела вне Интернета хорошую статью о РАДАСТЕЕ, договорилась с ее автором – и предлагаю вам почитать эту статью.

Радастея – не секта

Интересно устроено человеческое восприятие. Всё, что не относится к его привычному трафарету умозаключений – не имеет права быть. У таких людей любое «нетрафаретное» событие, действие вдруг получает негативную оценку. Хотя разве не скучно быть однозначными? А главное – может, стоит хоть немного поразмыслить?

За время своего существования РАДАСТЕЯ, или Метод 7Р0, созданный Евдокией Дмитриевной Марченко, обросла множеством мифов и легенд. Один из них – «Радастея – секта». Только понятие «секта» изначально применялось к религиозным группам. Что, времена поменялись? И сейчас этим словом называют всё, что каким-то образом не укладывается в чью-то систему понимания и вызывает негативную реакцию? Каким образом Радастея относится к секте, если она в корне не соответствует определению «секта»?

РАДАСТЕЯ – никакая не религиозная группа

И тем более не несет на себе задачу противопоставления какой-либо религиозной общине. Люди, занимающиеся в РАДАСТЕЕ, свободные в своем вероисповедании. И более того, труды РАДАСТЕИ направлены на изучение субстанции времени и его влиянии на мозг человека, а не на вопросы религиозных конфессий. И вообще, вопрос религии – это всего лишь маленький островок среди всех знаний, что освещает Радастея. Уж тем более РАДАСТЕЯ – не отделившаяся и не закрытая группа людей. На территории России и стран ближнего зарубежья давно успешно функционируют открытые клубы и салоны-магазины «Живая книга», где любой может приобрести уникальные знания о человеке и его жизни.

Радастея открывает самое лучшее по всему миру

Но можно долго и упорно говорить самое лучшее, что сегодня по всему миру открывает РАДАСТЕЯ для сотни тысяч людей. И не уловить самого главного. И остаться в рамках своих убеждений. И даже не своих, а навеянных обществом и закостенелых в границах стереотипов.

Почему бы тогда не назвать нашу повседневную жизнь также сектой? Регулярный просмотр новостей и сериалов – чем не секта? Ведь это уже зависимость от телевизора. Сколько времени люди бесполезно тратят свою жизнь возле телевизора! А ежедневный поход на работу, на учёбу?

Университет, институт, колледж, школа, кружки рисования, пения тогда тоже можно назвать сектой. Ведь и туда уходит наше время и внимание. И там и там – свои задачи, которые человек должен выполнять. И еще за это он получает оценки! Вдруг он отошел от правил поведения и его могут исключить! А молодежные группы, которые делят себя по признаку, кто какую музыку слушает? А футбольные клубы мира? Ведь у каждого клуба есть своя специальная форма одежды, своя философия, своя определенная позиция. Свой идейный руководитель – тренер. И с точки зрения фанатов, переход футболиста из клуба в клуб может назваться «предательством». А предательство чего? Идею футбола и способность играть невозможно предать. Как и желание знаний. Так почему тогда РАДАСТЕЯ, которая даёт возможность просто знать и грамотно применять знания к жизни, – это секта?

Мы видим Солнце, но там его уже нет. Потому что человеческий взгляд опаздывает за истинным Солнцем на 8,3 минуты. Также, по сути, отстаёт и человеческое сознание в своём развитии, когда человек придерживается стереотипов и границ мышления. Давайте мыслить свободно и грамотно!

Эволюция познания и “Радастея”

“Радастея”

Познание как форма духовной деятельности существует в обществе с момента его возникновения и проходит вместе с ним определенные этапы развития.

На каждом из них процесс познания осуществляется в многообразных и взаимосвязанных социально-культурных формах, выработанных в ходе истории человечества. Поэтому познание как целостный феномен нельзя сводить к какой-либо из форм, хотя бы и такой важной как научное, которое, как считают современные ученые, не «покрывает» собой познание как таковое. Сейчас уже известно, что наука о познании не может строить свои выводы, черпая материал для обобщения из одной сферы — научной, даже если речь идет о «высокоразвитом естествознании».

Ученый мир в настоящее время не претендует на познание чистой истины, как и признает свою неспособность познавать сущее без остатка. Область категорий бытия и категорий познания совпадает частично, и только этим можно объяснить, что процессы природы кажутся совершающимися по математическим законам. На самом деле это условно-приблизительное объяснение наукой взаимодействия человека с воспринимаемой его сознанием «знаковой системой», посредством которой ему является Вселенная.

Анализируя исторические формы познания, которые на разных стадиях развития общества преобладали в нем, и имели различную степень влияния на познавательные процессы в целом, можно сказать, что наиболее эффективным является такой процесс познания, который включает в себя все существующие и существовавшие когда-либо способы познания действительности.

Уже на ранних этапах истории существовало обыденно-практическое познание, поставлявшее элементарные сведения о природе, а также о самих людях, условиях их жизни, общении, социальных связях и т.д. Основой данной формы познания был опыт повседневной жизни, практики людей.

Одна из исторически первых форм — игровое познание как важный элемент деятельности не только детей, но и взрослых. В ходе игры индивид осуществляет активную познавательную деятельность, приобретает большой объем новых знаний, впитывает в себя богатство культуры — деловые игры, игра актеров, в науке применяются специальные игровые модели, где проигрываются различные варианты течения сложных процессов решения научных и практических проблем. Целый ряд влиятельных направлений современной философской и научной мысли выдвигают игру в качестве самостоятельной области изучения.

Важную роль, особенно на начальном этапе истории человечества, играло мифологическое познание. В рамках мифологии вырабатывались определенные знания о природе, космосе, о самих людях, формах общения и т. д. В последнее время было выяснено, что так называемое мифологическое мышление — это не просто игра фантазии, а своеобразное моделирование мира, позволяющее фиксировать и передавать опыт поколений.

Уже в рамках мифологии зарождается художественно-образная форма познания, которая в дальнейшем получила развитое выражение в искусстве. Хотя считается, что художественная деятельность несводима целиком к познанию, но познавательная функция искусства посредством системы художественных образов — одна из важнейших для него.

Одними из древнейших форм познания, генетически связанными с мифологией, являются философское и религиозное. Особенности последнего определяются тем, что оно рассматривает формы отношения людей к господствующим над ними земными силами.

О существовании неких общих законов познания говорили еще древние философы [1]. Гераклит в процессах изменения мира видел исполнение законов «единого мудрого», которые присущи и бытию и познанию. Чтобы постигнуть природу каждого отдельного предмета, нужно уметь приложить общий закон. Подчеркивая активную роль субъекта в познании, философы-софисты придавали большое значение анализу возможностей слова и языка в познавательном процессе.

Аристотель важнейшим инструментом познания считал логику [2]. Он пытался вывести свою логику за рамки формальной, он ставил вопрос о содержательной логике, о диалектике. В логических формах и принципах познания он видел основные формы и законы бытия.

В европейской философии теория познания занимала центральное место [1]. Ф. Бэкон считал, что науки, изучающие познание и мышление являются ключом ко всем остальным, ибо они содержат в себе «умственные орудия», которые дают разуму указания или предостерегают его от заблуждений. Кант в своей гносеологии исследует три основных способности познания — чувственность, рассудок и разум. Философ рассматривает два вида логики: анализ и синтез. Именно синтезу Кант придаёт значение фундаментальной операции мышления, так как именно с его помощью происходит образование новых научных понятий о предмете.

Гегель считал, что теория познания не должна содержать пустые, мертвые формы мысли и принципы, в нее должна войти вся жизнь человека. Исследование всеобщих закономерностей жизни человека является ключом к разгадке тайны логических категорий, законов, принципов и механизма их обратного воздействия на практику.

“РАДАСТЕЯ” постановка реально- фантастического романа

Книга «Радастея» Евдокии Марченко – это самый перспективный прогноз будущего, ради которого хочется жить. Он основан на бесконечной вере в человеческий разум и способности людей. “Радастея” кажется невероятной фантастикой и дразнит близостью своей реальности. Где отношения между людьми тонкие, бережные, внимательные, выверены и лишены негатива, где взаимодействие с живой и не живой природой гармоничны и целесообразны, где человеческий мозг гибок, подвижен и развит, где окружающие события и жизнь наполнены радостью и смыслом. “Радастея” переносит в неведомые пространства, и представляет удивительных существ. Необычность захватывает, и далеко не сразу понимаешь – это просто люди. Люди, которые живут по-другому.

Ритмолог Марианна Мигович в прямом эфире на канадских телевизионных каналах!

Ритмолог Марианна Мигович, ведущая вебинаров на нашем сайте, будет давать интервью о Методе 7Р0 в прямом эфире на телевидении Канады. И это произойдёт уже совсем скоро! Присоединяйтесь к просмотру!

Ритмолог Марианна Мигович, ведущая вебинаров на нашем сайте, будет давать интервью о Методе 7Р0 в прямом эфире на телевидении Канады. И это произойдёт уже совсем скоро! Присоединяйтесь к просмотру!

21 Августа 10 утра по Торонто ( 18.00 мск. время)

ТОЛЬКО НА КАНАЛЕ RTVi –

ПРЯМОЙ ЭФИР НА РУССКОМ ЯЗЫКЕ

ПО ВСЕЙ КАНАДЕ

В ПРОГРАММЕ «ОДИН ИЗ НАС» :

«НИЧЕГО СЛУЧАЙНОГО НЕ БЫВАЕТ!»

В СТУДИИ В ПРЯМОМ ЭФИРЕ

МАРИАННА ЛИНДГРЕН-МИГОВИЧ,

КОНСУЛЬТАНТ – РИТМОЛОГ

ИНСТИТУТА РИТМОЛОГИИ – ИРЛЕМ

Одновременная трансляция пройдет на канадских телевизионных каналах

Rogers Cable , Bell TV, NEXTV (http://www.getnextv.com)

Одновременно в интернет! http://www.moetv.ca

21 Августа 10 утра по Торонто ( 18.00 мск. время)

- Вы узнаете:

Что предопределяет жизнь человека?

Как мы можем влиять на свою жизнь?

Что случайно, а что может быть исправлено в вашей судьбе?Вы можете задать вопрос консультанту – ритмологу в прямом эфире.

ТЕЛЕФОНЫ ПРЯМОГО ЭФИРА в Торонто теле- студии:

416-736-9559; 1-866-365-6718

Звоните, ждём ваших интересных вопросов.

Повтор программы на канале в понедельник в 4 часа и во вторник в 7 утра

Смотри наши программы на канале «Русское ТВ» на Youtube

http://www.youtube.com/bronnmedia

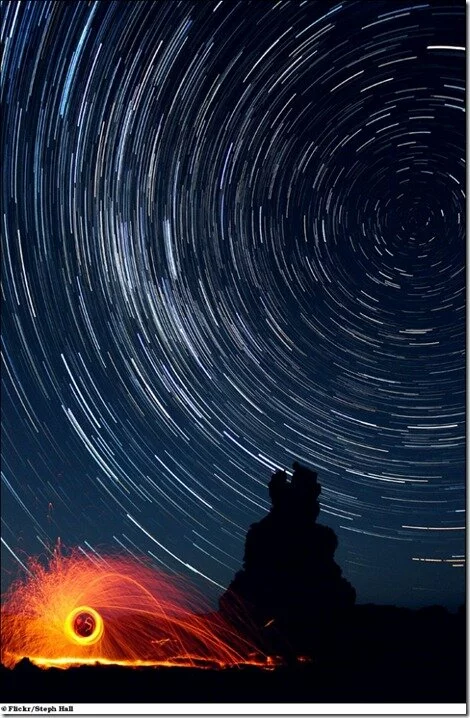

Королевская обсерватория Гринвича проводит соревнования на лучшего астрофотографа

Это небольшой обзор конкурса на лучшую астрофотографию, который ежегодно проводит Королевская обсерватория Гринвича. Участником соревнования может стать любой желающий астрофотограф. На сервисе Flickr существует специальная группа, где выбирают участников конкурса, составляется шорт-лист, а затем оглашаются победители в той или иной номинации. В середине июля был закончен набор работ, а 9 сентября будут оглашены победители. Выставка работа будет проходить с 9-го сентября 2010 по 9-ое января 2011 в Гринвиче. Под катом некоторые астрофото из короткого листа. (more…)

Первочувства, или Как настроиться на вселенную?

![]() Вселенная льется потоками в каналы человеческого восприятия. У каждого из нас пять таких каналов, пять органов чувств

Вселенная льется потоками в каналы человеческого восприятия. У каждого из нас пять таких каналов, пять органов чувств

Мы запоминаем то, что видим, слышим, вдыхаем, к чему прикасаемся и что ощущаем языком. В бесчисленных комбинациях в нас втекают цвета, звуки, запахи, вкусы и тактильные ощущения. Далее каждый канал соединен с определенным резервуаром — отдельной зоной мозга. Там и хранится всё, воспринятое нами за жизнь.

В нужном русле…

У большинства людей все эти огромные пласты хранятся так, как и поступили на внутренние склады — беспорядочно и вперемешку. Лишь немногие разумно сортируют свои накопления. Да и то, как правило, в каком-нибудь одном ведущем направлении, часто связанном с профессией. Художники различают множество цветов, текстильщики видят до 200 оттенков черного цвета, а сталевары — до нескольких сотен тонов красного.

Музыканты имеют тонкий слух, дегустаторы и парфюмеры улавливают такие нотки вкуса и запаха, что для обычного человека это кажется колдовством, а, скажем, тайские массажистки тонко работают с прикосновениями.

О Таиланде мы упомянули не случайно. Разные народы по-разному тренируют такие способности. Так, в русском языке существуют десятки слов для обозначения всевозможных цветов и оттенков, а в японском — не менее шестисот! Кстати, о жителях Страны Восходящего Солнца…

В истории человечества встречались персонажи, для которые было важно развитие не одного, не двух, а всех каналов чувств. Пример выдающихся результатов в этом направлении — кланы японских наемников, ниндзей, чья сверхъестественная интуиция стала легендой. В тренировки этих воинов входили упражнения, направленные на обострение каждого канала чувств, каждой зоны восприятия. В один из дней ниндзя просыпался и, не открывая глаз, втягивал ноздрями воздух, концентрируясь затем целый день только на запахах. На следующий день — на всевозможных звуках, улавливал самые мельчайшие нюансы, потом — все внимание направлял на цвета, вкусы, ощущения…

Но ниндзя тренировались годами и десятилетиями, что при современном ритме жизни неоправданно расточительно. Тем более, сегодня есть метод, который гораздо быстрее позволяет выйти на «чувствознание» — соединение всех пяти своих главных ощущений среди пяти чувств. Этот метод поиска «первочувств» разработан в Институте ритмологии Евдокии Марченко, который занимается временем и помогает человеку выйти на свой собственный ритм, с которым он совершенен и всесилен.

Где у него кнопка?

Ритмология говорит, что у каждого из нас есть ведущее чувство — оно сильнее остальных пяти. Если у человека нарушен комфорт в ведущем чувстве, он становится недоволен всем, впадает в депрессивные состояния. Каждому полезно знать свой приоритет, тогда он сможет быстро и легко восстанавливаться. Кто-то слушает музыку, кому-то нужны поглаживания и горячая ванна, кого-то достаточно правильно покормить, а кого-то мгновенно вдохновят краски заката или любимая картина.

Кроме того, в Институте ритмологии выделяют еще одно интереснейшее поле исследования своего внутреннего мира. Если среди пяти чувств существует одно, ведущее, то и в «терминалах памяти» хранится главное ощущение. Именно оно приходит на ум первым, когда надо подумать о том или ином предмете, событии. Первоощущение может быть первоцветом, первозвуком, первозапахом, первовкусом или первотактом. Об этом человек задумывается ещё меньше. Но ведь именно это — настоящий тайный рычаг управления. Вспоминается задумчивый Басов в «Приключениях Электроника» с вопросом: «И все-таки, где же у него кнопка?»…

Пока вы не нашли свои первоощущения, вы уязвимы. Если ваши основные струны затронет другой, он сможет легко манипулировать вами. Первочувство — на самом деле абсолютно реальная кнопка управления человеком, и каждый раз, когда её нажимают, он готов сделать все, чтобы испытать их. Так, одна моя знакомая страдала от ссор и грубости со стороны близкого человека, прощая ему всё и не подозревая, что цвет его глаз был её первоцветом. Если же человек нашел и знает свои кнопки, он способен самостоятельно управлять собственными рефлексами. При нахождении пяти своих первоощущений и соединении их в единое, возможен выход на соединение интуиции и знания. Человек интуитивно чувствует, но, так как включился мозг, поработавший на своих складах, добавляется и осмысление происходящего. Чувство и знание соединяются в чувствознание. Это дает невероятную устойчивость и силу в этом мире. Человек практически не ошибается, так как ощущает одномоментно и запах, и вкус, и цвет, и звук, ощущает кожей — и с помощью этого настраивается на информационные каналы Вселенной, на свой «вселенский ритм».

Источник Аргументы и факты Online

Сон – опережая реальность

Настоящее знакомство с темой сон у меня началось задолго до изучения метода 7Р0. А по настоящему состоялось уже в методе.

Впервые я узнал, что бывают осознанные сновидения из книг Карлоса Кастанеды. Сон – это реальность, которая существует, говорилось в его книгах.

Через интернет, вышел на англоязычную группу исследователей. Они называют себя онейронафтами. Их базой были разработки Натаниэл Клётмана, о фазе быстрого сна и его опыты в сомнографической лаборатории в Стэндфордском университете. Квинтэссенцией их работы стала практическая книга, как входить в осознанные сновидения.

Занимаясь по этой книге два месяца у меня впервые получилось войти в осознанный сон. Осознав себя во сне, решил слетать на египетские пирамиды. Было мощно, реалистично.

Занимаясь по этой книге два месяца у меня впервые получилось войти в осознанный сон. Осознав себя во сне, решил слетать на египетские пирамиды. Было мощно, реалистично.

После этого сна у меня был невероятный подъём, на протяжении двух недель – словно на крыльях летал. В ритмологии, узнал что египетские пирамиды – одно из 25 чудес света, которые хранят огромную энергию.

С ритмомерой СОН – всё было проще, быстрее и невероятно интересней!

Прочитав один раз главу СОН из книги Ритмомеры, я увидел своё будущее на пол года вперёд. Я знал как себя вести чтобы всё состоялось. Видел людей, их взаимодействие и понимал как мне надо делать чтобы состоялось то великое дело, которое мне надо осуществить.

Сейчас, когда прошло два года с тех событий. Могу с уверенностью сказать: благодаря ритмомере СОН, я знал будущее и мне это очень помогло.

На этот момент, достаточно часто приходят такие же сны. Чётко знаю, по особому состоянию во сне, что именно этот сон о будущем, настоящем или о прошлом. Если он о будущем и я могу заранее приблизить то что мне нравится или отдалить то что мне не нужно. Методикой коррекции 7Р0.

На этот момент, достаточно часто приходят такие же сны. Чётко знаю, по особому состоянию во сне, что именно этот сон о будущем, настоящем или о прошлом. Если он о будущем и я могу заранее приблизить то что мне нравится или отдалить то что мне не нужно. Методикой коррекции 7Р0.

Всё что нужно – это перед сном сделать 15-ти минутную подготовку по ритмомере “СОН”.

Настоятельно вам рекомендую использовать скрытые возможности сна. А для этого вам лучше всего подписаться на рассылку из которой вы узнаете больше о методе 7Р0. http://sun.radast.org

С уважением, Артём Тимофеев.

Интолог.

Узнайте о интологии – логике интернет. Как целенаправленно извлекать максимум возможностей из интернет.

Мой микроблог: http://twitter.com/timofeev

Тактичное касание

![]() Страна тактильных ощущений — это не эротический массаж (хотя, и он тоже), а экскурсия в глубины своей памяти. Ещё раз вспомним, зачем это нам нужно…

Страна тактильных ощущений — это не эротический массаж (хотя, и он тоже), а экскурсия в глубины своей памяти. Ещё раз вспомним, зачем это нам нужно…

Мы уже не раз писали о том, что у человека из пяти каналов восприятия есть один самый сильный. Именно через него мы получаем так называемые первочувства и первознания (первое ощущение, приходящее на ум при упоминании чего бы то ни было). На прошлой неделе мы говорили о запахе. Наше второе путешествие состоится в мир прикосновений, скольжений, поглаживаний.

Страна тактильных ощущений — это не эротический массаж (хотя, и он тоже), а экскурсия в глубины своей памяти. Ещё раз вспомним, зачем это нам нужно.

Пока человек не нашёл свои первочувства, он уязвим. Первочувство — это кнопка управления человеком, и каждый раз, когда ее нажимают, он готов сделать всё, чтобы испытать эти ощущения. Если же человек знает свои кнопки, он способен самостоятельно управлять собственными рефлексами. Термин «первочувства» введен учёным Евдокией Дмитриевной Марченко и обозначает одно из направлений, которые изучаются в Институте Ритмологии (ИРЛЕМ).

Справка:

Тактильные ощущения (от лат. tactilis — осязательный) — форма кожной чувствительности. Различный характер имеют ощущения, вызываемые прикосновением, давлением, вибрацией, действием фактуры и протяженности. Обусловлены работой двух видов рецепторов кожи: нервных сплетений, окружающих волосяные луковицы, и капсул, состоящих из клеток соединительной ткани.

Всей кожей…

Тактильные ощущения примечательны тем, что мы способны воспринимать их всей поверхностью тела. Мы — одно сплошное тактильное ощущение, когда загораем, купаемся или когда нас обдувает ветер.

Осязание влияет на нас — в той или иной степени это испытывал каждый. После прикосновений любимого человека остается память, остаточная намагниченность его рук. Если есть тактильная зависимость, человек забывает обо всем, ради того, чтобы снова и снова повторять эти ласки.

Развить осязание можно до очень высокого уровня. Например, известны слепые скульпторы, делавшие великолепные бюсты известных людей. Представьте, насколько «зрячими» были их руки, которые трогали лица, а потом с изумляющей точностью воплощали это в материи!

Вспомните свой «первотакт». Может быть, это касания пальцев любимой или любимого, прикосновение мамы, которая гладит голову, или первое мгновение погружения в горячую ванну. А может, что-то ещё…

Вот что пишет участник одного интернет-форума: «Если женщину каждый вечер перед сном всю оглаживать, а ещё лучше — делать ей массаж, — то она никогда не будет с вами скандалить, бить посуду и вообще будет вам верна навеки».

Она — персик!

В уже упомянутой ритмологии «первотакт» и «первовкус» различаются, но всё равно они близки. Ведь в обоих случаях мы воспринимаем мир поверхностями — кожи или языка.

Как слово «такт» можно использовать в переносном смысле, так и слово «вкус» используют для обозначения человека тонкого и изысканного, про которого так и говорят: «У него есть вкус». Вкусовые ощущения не случайно перенесены из сугубо внутренних во внешний мир. Знание своих вкусов во всех смыслах позволяет вступать с миром в особенно интимный контакт и чувствовать всё богатство его оттенков.

Как сказал один писатель: «Понятие дегустации для меня воплощает не только вкусовое узнавание напитков и еды, но и попытку по маленькому фрагменту понять целое, узнать новое о жизни и людях».

С этой фразой созвучен фильм «Настоящая любовь», где впервые свой талант демонстрировал Квентин Тарантино (ещё не как режиссер, а как автор сценария). В ленте есть сцена, где сын со своей девушкой приезжает к отцу. Тот спрашивает, за что он её любит, и сын отвечает: «У неё вкус персика». На прощание девушка очень откровенно целует папу в губы… Отец глядит вслед удаляющемуся автомобилю со словами: «Он прав…Персик».

Источник Аргументы и факты Online

P.S.: Подписывайтесь на новости сайта radast.org [RSS]

Запах приключения

![]() Недавно мы писали о том, что у человека из пяти каналов восприятия есть один самый сильный

Недавно мы писали о том, что у человека из пяти каналов восприятия есть один самый сильный

Именно через него мы получаем так называемые первочувства и первознания (первое ощущение, приходящее на ум при упоминании чего бы то ни было). Сегодня мы поговорим об этом подробнее.

Обострённое обоняние

Начнем с мира запахов. В носовой полости человека находится особая ткань — обонятельный эпителий. Он первым воспринимает информацию о запахе и затем передает её основному органу — обонятельной луковице, самому древнему участку головного мозга. Это подобно хвостику, за который человека легко привязать к чему угодно. Такое часто происходит с мужчинами, которые среди множества запахов безошибочно узнают аромат своей возлюбленной — её духов, кожи, волос. Известно, что некоторые коммерческие фирмы пропитывали летним запахом зимний товар, и люди раскупали ненужные им летом вещи. В храмах прихожан умиротворяет запах свечей и ладана. Без запахов не обходятся в своих ритуалах маги, шаманы и колдуны.

Можно вспомнить героя романа Патрика Зюскинда «Парфюмер» — великого и ужасного Гренуя, который в мире запахов был богом. Книга до сих пор (и тем более после экранизации) числится в списке бестселлеров, и одна из причин этого состоит в том, что в мировой литературе нет аналогов такого гениального художественного исследования ведущего чувства.

С книжных страниц перенесемся в реальность, в начало двадцатого века, хотя и эта жизнь вполне могла бы послужить сюжетом не одного романа. Мария Игнатьевна Закревская-Бенкендорф-Будберг, или, как её звали друзья, Мура, была легендарной женщиной своего времени, музой и помощницей многих великих людей. Все, кто ее видел и с ней общался, единодушно признавались, что Мура дьявольски обаятельна. Жертвами ее чар стали и Фрейд, и Ницше, и Рильке. А ещё Чуковский, и даже такие суровые мужчины, как руководители ЧК Петерс и Ягода. Шепотом поговаривали, что этого не избежал сам Сталин. Ею были околдованы Максим Горький и Герберт Уэллс. К моменту встречи с Уэллсом она успела дважды побывать замужем, не говоря об остальных её романах. Но последние 13 лет жизни Уэллса (а умер он почти в 80 лет) Мура находилась рядом с ним.

Секрет раскрывался просто. В 1934 году английский писатель Сомерсет Моэм довольно ревниво спросил Муру, как она может любить Уэллса, этого толстого вспыльчивого старика. Она ответила: «Вы ничего не понимаете. Его невозможно не любить — он пахнет мёдом».

Ритм, дарящий силы

В нашей памяти хранится любимый запах, на который мы уже испытывали в жизни максимальный отклик. Это как некий первичный импульс, ведущий ритм в мире обонятельных ощущений, и логика этого ритма определяет многие наши действия, часто подсознательно, совсем незаметно для нас. В современной науке — психологии, медицине — часто занимаются лишь следствиями первопричин, и не так много тех, кто идет к реальным истокам.

Например, в Институте ритмологии Евдокии Марченко (ИРЛЕМ) занимаются изучением именно логики ритмов, которые управляют жизнью человека, общества, Вселенной. И это не какая-то абстракция, а то, что можно буквально применить даже к тому, как и чем мы дышим.

Обычно наш первозапах идёт из детства, но мы его не помним и не осознаем. Его можно оживить, стимулируя свой мозг целенаправленными вопросами. Легко ли вы отличите по запаху апельсин от лимона? Полынь от хризантемы? Красную розу от белой? Какой для вас «запах весны», «запах влюбленности», «запах горя», «запах приключения»? Чем пахнет книга, стол, вода?

А ещё можно прожить целый день, с момента пробуждения, концентрируя внимание только на обонянии. Проснуться и, не открывая глаз, втянуть ноздрями воздух, а потом все время наблюдать и осознавать все окружающие запахи. Очень увлекательно и полезно. Так тренировались японские наемники ниндзя, и если даже вас не ждёт в будущем какая-то опасная и невыполнимая миссия, вы, как минимум, откроете для себя дополнительный мир. Определив личный первозапах, вы сможете в любой момент оживить его в памяти и получить импульс своего ритма.

Источник: Аргументы и факты Online